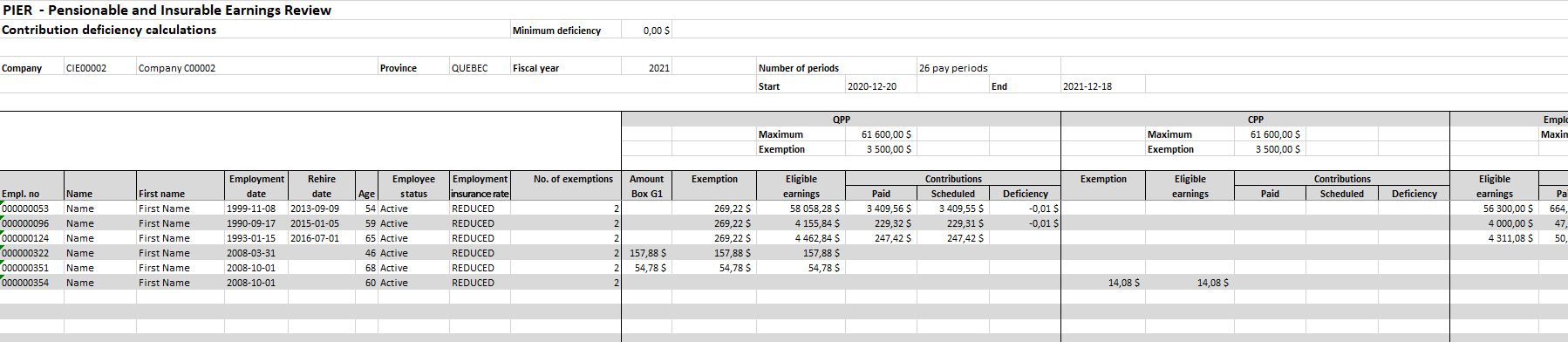

The Pensionable & Insurable Earn report is designed The Pensionable & Insurable Earnings report is designed find differences between the contributions withheld from employee pay (QPP/CPP, EI, or QPIP) and the contributions required based on the insurable earnings reported.

✓You must verify these differences to determine whether they are justified or if adjustments are required.

✓The report will be generated automatically with each payroll processing if there are differences.

✓To access the report, go to Payroll reports (XML, CSV) function (Reports > Payroll results > Payroll reports (XML, CSV)).

|

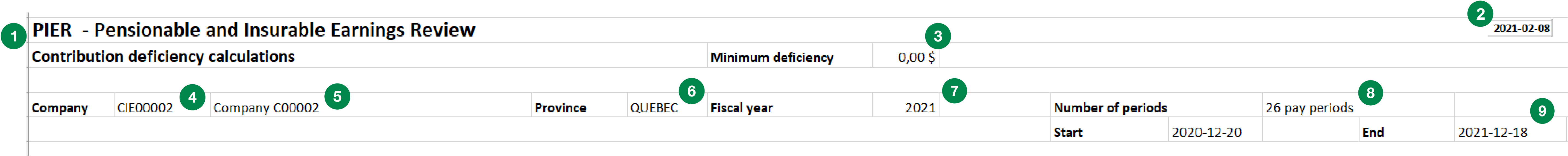

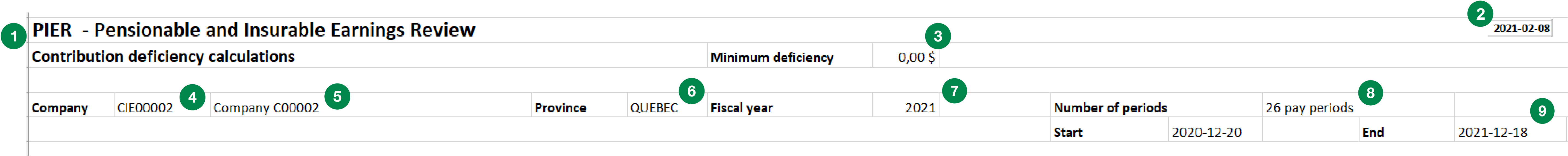

The heading contains the following information pertaining to your company file:

1Report title and subtitle

2Report production date

3Amount of minimum deficiency for the company

4Company number

5Company name

6Company province

7Fiscal year of the report

8Number of pay periods

9Starting and Ending date of the report |

|

|

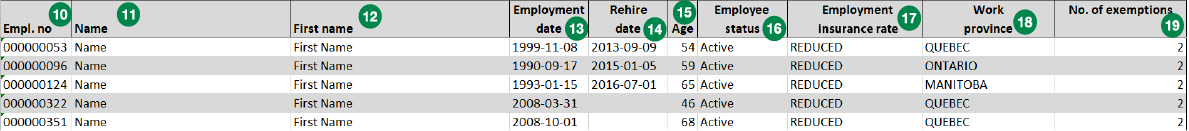

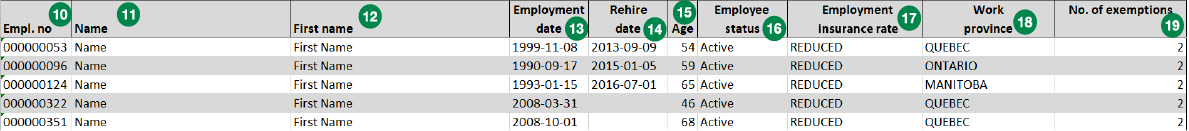

The block contains the following employee information:

10Employee number

11Employee Name

12Employee First name

13Employment date

14Rehire date

15Age

16Employee status

17Employment insurance rate

18Work province

19Number of exemptions calculated |

|

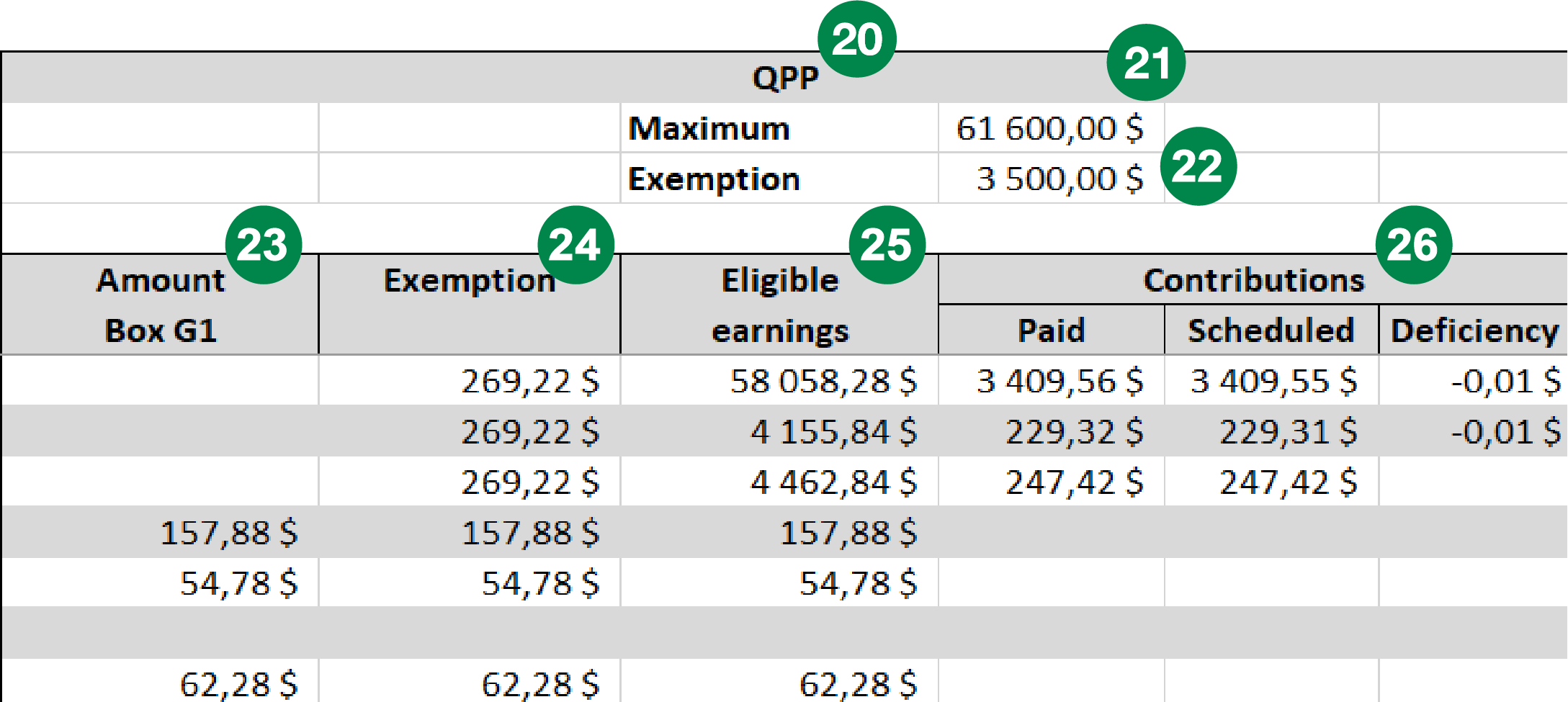

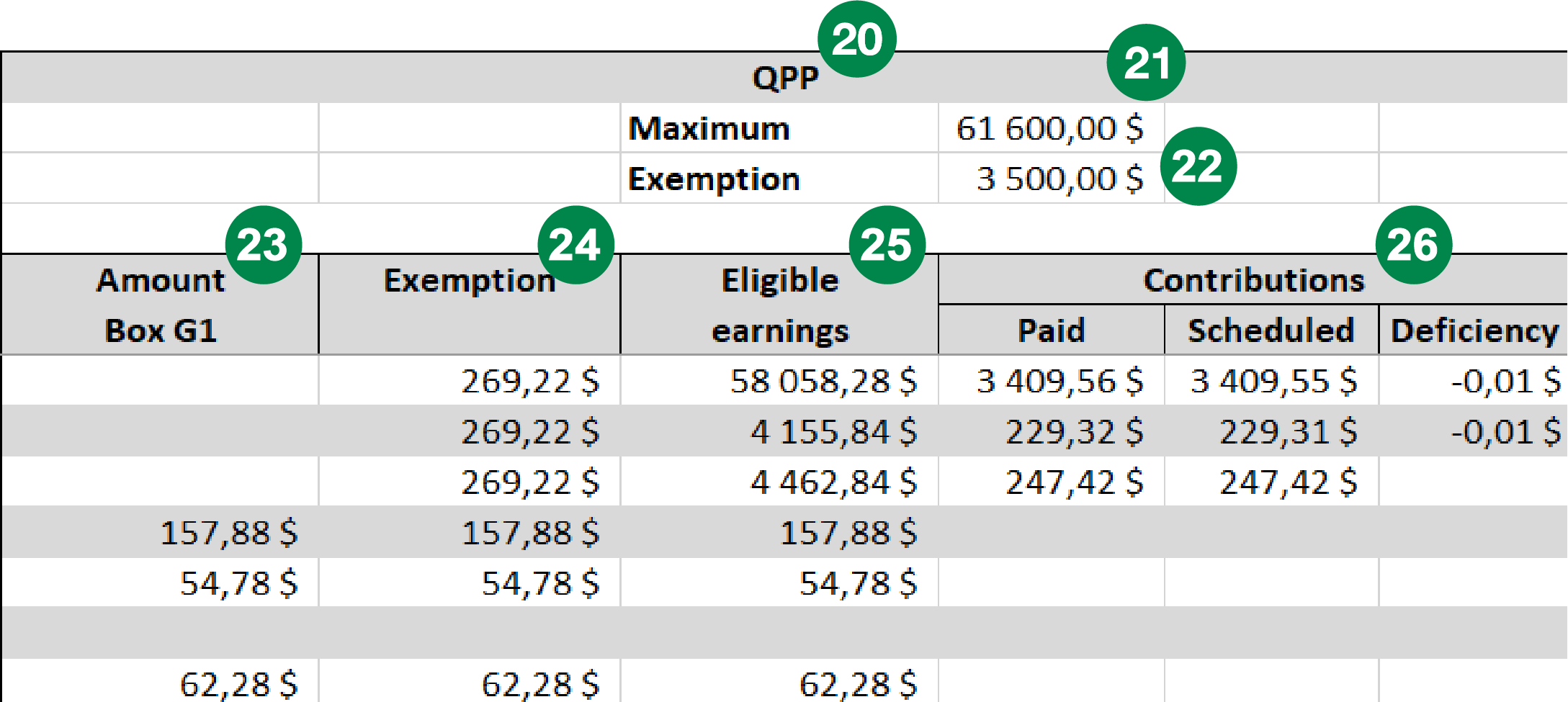

All targeted deduction blocks (EI, CPP, QPIP, and QPP) contain the same columns in which employee year-to-date data is indicated. If an employee does not have year-to-date data for certain deductions, the corresponding cell under that column will remain blank.

|

|

20Name of deduction (EI, CPP, QPIP, or QPP)

21Annual maximum eligible earnings per employee

22Maximum annual QPP general exemption per employee

23Amount in box G1 represents the benefits from which no contribution was withheld

24Employee exemption amount

25Total eligible earnings

26Contributions section:

oPaid: Total paid by the employee

oScheduled: Total that should have been paid by the employee

oDeficiency: difference between the amount Paid and the amount Scheduled |

Things to remember

If you have no employees in Québec: the columns for the Québec deductions will not appear.

|

|

|

The following table includes the situations most likely to cause deficiencies and may serve as a guide to help you.

Types of action

|

Deficiency causes

|

Tools available on the portal

|

Manual payment

|

Manual transaction (manual check) without required deductions or with erroneous deductions.

|

Payroll record - SPD603

The history of Year-to-dates, Payments or Eligible earnings (Access: Employee file > History)

|

Addition/removal

of earnings

|

When eligible earnings (distribution codes) are created without opening the deductions in the matrix.

|

Validation of distribution codes - SPD655 report

|

Other

|

Modifying the age of an employee

|

Modification History

(Access: Employee file > Employee > History > Employee profile modification)

|

Complementary tips

If you changed payroll frequency during the year:

✓This may have an impact on the number of exemptions allotted, as the number of exemptions is tied to the number of payrolls processed until the maximum contribution is reached.

✓Note that the report does not perform this operation. If applicable, you must do the calculation yourself and make the necessary adjustments in your current pay.

If an employee has more than one employee number:

✓If year-to-date amounts are combined for all employee numbers attributed to the same employee, the maximum contribution could be exceeded.

✓Note that the report does not perform this operation. If applicable, you must do the calculation yourself and make the necessary adjustments in your current pay. |

|

You can adjust the employee year-to-date amounts in the application during current payroll data entry as well as by making YDT adjustments.

Access in the payroll application

|

|

|

|

|

|

Access in the payroll application

|

Year-end > Enter YTD adjustments >

|

|

|

Adjustments for fewer than five (5) employees

|

Adjustments for more than five (5) employees

|

To make year-to-date adjustments for fewer than five (5) employees, you must provide your payroll agent with the adjustment amounts for each employee during the current payroll.

|

To make year-to-date adjustments for more than five (5) employees, you must send an email request two business (2) days prior to the date of your payroll data entry.

|

After the payroll is processed, you are responsible for verifying your payroll reports to ensure that the requested adjustments After the payroll is processed, you are responsible for verifying your payroll reports to ensure that the requested adjustments

have been made and the amounts are accurate.

|

For year-to-date adjustments during the year-end period, you must fill out the Excel spreadsheet available in our application’s

Documentation section and send it to our customer service by using the Contact us function ( > Contact us). > Contact us).

Access :  > Documentation > Forms > Year-end- Year-to-date Adjustments and Pension Adjustment > Documentation > Forms > Year-end- Year-to-date Adjustments and Pension Adjustment

|

|