![]() Attention:

Attention:

⇨ This procedure has been designed to help you complete the PDF version of the form only. Our payroll service does not have access to the electronic version of Clic Sécur.

✓Note that Desjardins Employer Solutions cannot complete the RL-1 Summary for you, Revenu Québec (RQ) requires employers to complete and sign this form themselves. To this end, Revenu Québec now accepts electronic signatures for the RL-1 Summary. Besides, some of the required data in regards to your company is not available in our systems. ✓Deadline: Revenu Québec must receive the summary in their office by the last day of February (postal* or electronic). ✓As a reminder, the payroll application sends the federal summary directly to Canada Revenue Agency together with your tax slips. |

To help you complete the PDF version of the RL-1 Summary, we have identified the sections of the reports where you will find the information required to fill out the Summary. Simply transcribe this information in the boxes marked with the corresponding letters on the RL-1 Summary.

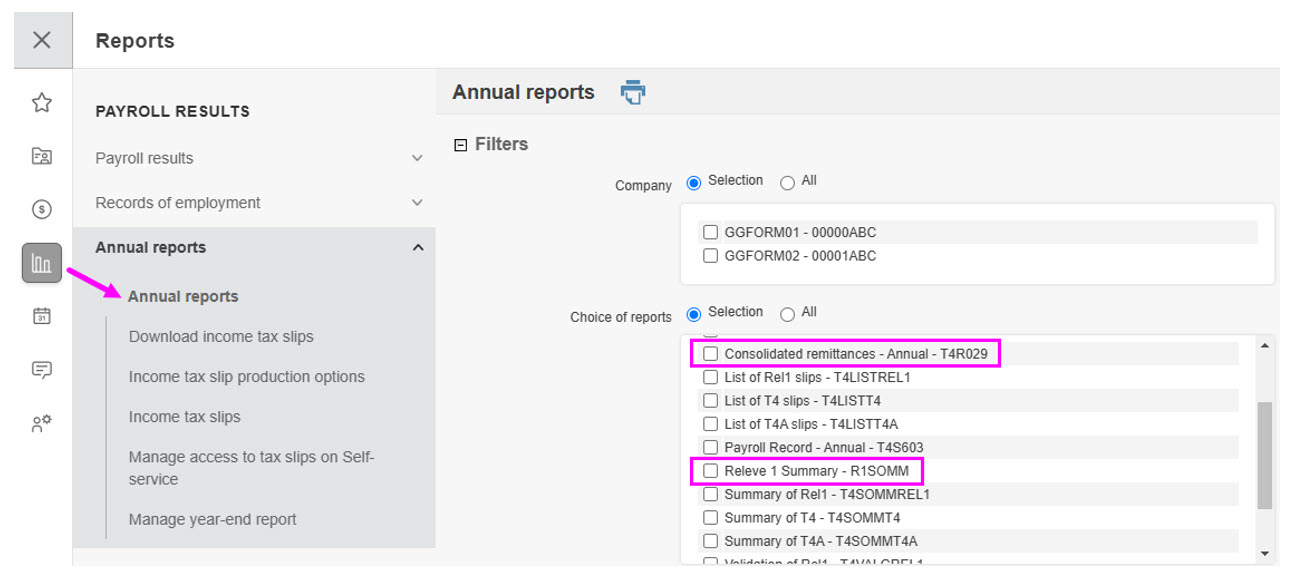

Before completing the PDF version of the RL-1 Summary, make sure you have the following documents on hand: oThe Summary of Source Deductions and Employer Contributions – RL-1 Summary (RLZ ‑1.S‑V form) sent by RQ; oThe following year-end report: Releve 1 Summary – R1SOMM and Consolidated remittances – Annual T4R029. You can download your reports via this screen;

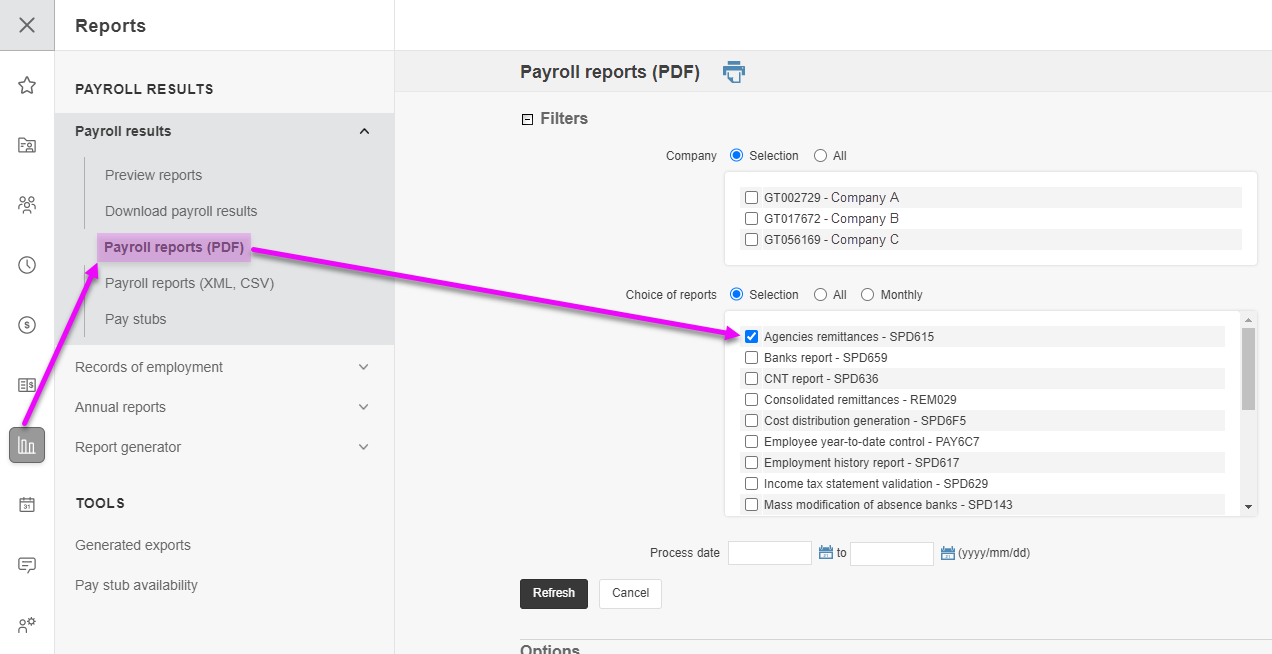

oNEW! A section entitled Summary of provincial remittances paid is now available at the end of the Consolidated Remittances – Annual – T4R029 report. It contains the remittance amounts to be entered on the first page of the RL-1 Summary oThe last Agencies remittances – SPD615 of the year. You can download your reports via this screen.

|

You can send the PDF version of the RL-1 Summary, remittance slip, as well as a cheque or money order (if applicable) to Revenu Québec via My account for businesses or to one of the following addresses:

Montreal, Laval, Laurentides, Lanaudière and Montérégie: Revenu Québec

Quebec and other regions: Revenu Québec |

The information reflects the norms, guides, or forms as well as the legislation in effect at the time of its publication. Should changes be made to these norms, guides or forms, or even to the legislation,

note that the information will not be amended. In such cases, you will have to refer to the different notices that we will produce on the subject.

Go back to the table of content